Climate Policy Initiative Report on Financing Renewable Energy in India

The government of India has an ambitious plan for renewable energy technologies with the National Solar Mission the most popular scheme to be launched under the climate change mission. However, lack of debt instruments, high cost and risks are bottlenecks towards the growth of this sector.

The government of India has an ambitious plan for renewable energy technologies with the National Solar Mission the most popular scheme to be launched under the climate change mission. However, lack of debt instruments, high cost and risks are bottlenecks towards the growth of this sector.

The Climate Policy Initiative has come out with a report entitled, “Solving India’s Renewable Energy Financing Challenge: Instruments to Provide Low-cost, Long-term Debt.” As per the report’s findings,

“the biggest barrier to renewable energy in India is the inferior terms of debt – i.e., high cost, short tenor, and variable rate – which raises the cost of renewable energy in India by 24-32% compared with similar projects in the US.”

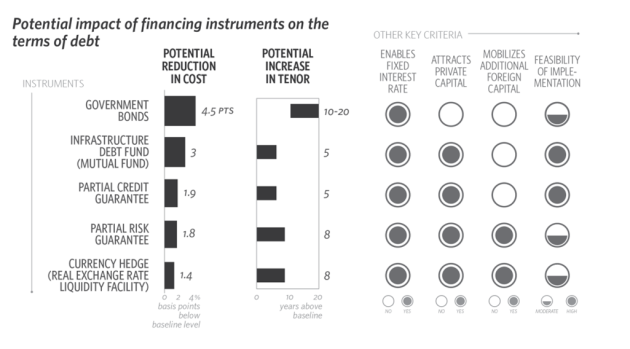

The report by Climate Policy Initiative and Indian School of Business explored three categories of debt finances, “(a) instruments that provide access to previously untapped low cost, long-term funds from domestic capital markets; (b) instruments that provide access to foreign debt; and (c) guarantee instruments that mitigate the risk associated with projects.”

Source: CPI Analysis

* The baseline cost is 12.8%, which is the average annual return of an “A” rated bond.

+ Actual cost reduction depends on the structure of the guarantee

~ We assume the developer avails an interest rate swap for foreign debt

# Based on baseline foreign debt cost of 13%

Mr. Gireesh Shrimali – Fellow, Climate Policy Initiative answered queries by GCG. Following is the copy of our questionnaire with him-

GCG- Do you see investments rising in India especially in the wind sector and other renewable sources after the next government comes in?

We cannot speculate on this; however, establishment of a stable, long-term renewable policy would surely help. For example, according to our report, “Falling Short: An Evaluation of the Indian Renewable Certificate Market,” establishment of legal renewable portfolio obligations and ensuring compliance would go a long way towards reaching the goal of 15% of electricity generation from renewable energy by 2020.

GCG- India has launched the National Electric Mobility Mission plan with subsidy for electric vehicles. Which in your opinion is a better model for pushing growth in renewable technology, better debt structure plan with ease of access to loans and easy repayment schedules or subsidies?

According to our analysis, described in “Solving India’s Renewable Energy Financing Challenge: Which Federal Policies can be Most Effective,” provision of concessional debt is a better policy than existing policies. For example, in the long-term, reduced-cost, extended-tenor debt can: (a) reduce the total cost of support by up to 78%, (b) provide 76% higher recovery of subsidies, and (c) incentivize generation.

GCG- Tell us about the Brazilian model and how the loan structuring scheme has pushed investments in renewable in Brazil.

According to our 2012 report, “Meeting India’s Renewable Energy Targets: The Financing Challenge,” Brazil has been successfully encouraging renewable energy investment through low-cost, long-term debt financing at large-scale. The National Bankfor Economic and Social Development(BNDES) has exclusive access to low-cost, risk-free funding from a workers’ welfare fund, and the bank sets a long-term interest rate which is 5.5%, with tenors of 16 years. This is well below the market rate of interest (30%) and the central bank’s interest rate (8.5%). The availability of BNDES low-cost, long-term loans cut renewable energy costs in Brazil by as much as one fifth, and has made wind energy competitive with conventional energy solutions.

GCG- As per your study, which instrument do you think is best suited for India or a combination of all would be a better way of going about it?

According to our recent report, “Solving India’s Renewable Energy Financing Challenge: Which Federal Policies can be Most Effective,” provision of concessional debt is the best policy – in the long-term, reduced-cost extended-tenor debt can reduce the cost of support by up to 78%, increase subsidy recovery by up to 76%, and also incentivize generation. In the short-term, if budget is an issue, interest subsidies are a good option – they can reduce the cost of support by 10% and increase deployment by up to 90%.

Further, according to another recent CPI report, “Solving India’s Renewable Energy Financing Challenge: Instruments to Provide Low-cost, Long-term Debt,” there are many instruments that can facilitate provision of concessional finance; however, there are tradeoffs. For example, government bonds can reduce the cost of debt by up to 4.5% and increase tenor by up to 10 years, but the government must take precautions so that government lending does not crowd out private financing.

Access CPI’s reports from following web address;

Falling Short: An Evaluation of the Indian Renewable Certificate Market: http://climatepolicyinitiative.org/india/publication/falling-short-an-evaluation-of-the-indian-renewable-certificate-market-2/

Solving India’s Renewable Energy Financing Challenge: Which Federal Policies can be Most Effective: http://climatepolicyinitiative.org/india/publication/solving-indias-renewable-energy-financing-challenge-which-federal-policies-can-be-most-effective/

Meeting India’s Renewable Energy Targets: The Financing Challenge: http://climatepolicyinitiative.org/india/publication/meeting-indias-renewable-energy-targets-the-financing-challenge-2/

Solving India’s Renewable Energy Financing Challenge: Which Federal Policies can be Most Effective: http://climatepolicyinitiative.org/india/publication/solving-indias-renewable-energy-financing-challenge-which-federal-policies-can-be-most-effective/

Solving India’s Renewable Energy Financing Challenge: Instruments to Provide Low-cost, Long-term Debt: http://climatepolicyinitiative.org/india/publication/solving-indias-renewable-energy-financing-challenge-instruments-to-provide-low-cost-long-term-debt-2/