Everything You Need to Know About Green Bonds in India

In COP21 – the United Nations Climate Change (UNFCC) conference – held in Paris in 2015 global economies committed to moving towards a low-carbon future. For instance, India pledged to reduce its greenhouse gas (GHG) emissions per unit of gross domestic product (GDP) by 33-35% (of 2005 levels) till 2030. The need for finance to carry out this transition has made ‘Green Financing’ the talk of the town. While there is no common definition of what constitutes green financing, the term is primarily used typically for funds earmarked to projects that are environment-friendly and low-carbon – encouraging resource efficiency, usage of renewable resources, or effective waste management.

Instruments to fund green projects

There are several instruments by which governments, foundations, banks, and private investors can fund ‘green’ projects. They can be categorized into grants, risk-mitigation products, equity, and debt. Project-specific grants such as for decentralized solar mini-grids for rural electrification – are usually provided by global foundations and NGOs. Risk-mitigation instruments include credit enhancement guarantees and insurance products. In guarantees, government organizations, development financial institutions (DFIs), or financial services companies can give assurance to lenders covering partial/entire payment in case of a default by the borrowers. Green insurance products provide environmental risk liability coverage and indemnify against climate/ecological losses. Under equity, the DFIs can provide early-stage seed capital to kickstart a project. Further, venture capitalists and private equity funds can invest in such projects/assets for an ownership stake or the general public can also invest via initial public offerings (IPOs).

Debt instruments are largely classified as two types – green loans and green bonds. Green loans are provided only by the banks but green bonds, also known as climate bonds, can be issued in general, for the broader investor market. In a bond, the holder is the lender, the issuer is the borrower, and the return to the lenders is in the form of fixed interest payments. Out of all the green finance instruments, green bonds have seen the most traction. According to the Climate Bonds Initiative (CBI) – an international not-for-profit organization – the global green bonds and loans issuance increased 51% y-o-y to reach ~$257 bn in 2019.

In India, one of the fastest-growing green bonds market in Asia – the first half of 2019 had $10.3bn of green bond transactions, as per the Economic Survey 2019-20. As noted previously, green bonds are like any other bonds but whose proceeds have been earmarked for specific “green” i.e. climate-friendly projects or assets. There are three broad types of green bonds – organization-guaranteed bonds, asset-backed bonds, and hybrid bonds – based on the source of repayment for the lenders and the available recourse in case of a default. Now, let us say an organization issues bonds for setting up a solar farm.

Type of bonds

The structure for the three bond types is explained below:

- In an organization-guaranteed bond (also called general obligation bonds), the credit-worthiness of the bond is based on the issuing organization and not just the financed asset, i.e. the solar farm. The farm is on the issuer’s books and the lenders are repaid by all sources of cash flow the issuer has and not just those arising from the farm. These bonds can be issued by the government, public institutions, or corporates. Some of these bonds are also convertible, i.e. the lenders are given an option to convert them into equity at a later date.

- In asset-backed bonds, the credit-worthiness is tied only to the expected revenue from the solar farm and not the other cash flows of the issuer. The solar farm asset is transferred into a separate entity, known as a special purpose entity (SPE) or special purpose vehicle (SPV). This entity holds just this asset. The repayment to the lenders will be done from the revenue earned from this farm only.

- A hybrid bond is a dual-recourse bond (also known as covered bonds) and can be structured in two ways. In the first method, the farm is on the books of the issuer and in case of a payment default the lender will own the farm and if the value of the farm is not enough to cover the default, then the lender will also have a claim on issuer’s other assets. In a second method, the farm is in an SPE, and in default, the assets of the SPE is transferred to the lender. Similar to the first method, if the value of the assets is not enough, the lender can place a claim on the issuer’s other assets as well.

Framework for Green bond issuance

To enhance the transparency and integrity of the green bonds market globally, there are a set of voluntary process guidelines – the Green Bond Principles (GBP) – issued by the International Capital Market Association. They recommend the issuers to create a framework for green bond issuing process across four key components. The first one is the use of proceeds where the GBP has defined what projects are eligible to be called as ‘green’. The second is the method of project evaluation and selection where the issuers need to communicate the project’s environmental objectives and the likely risks as well as their mitigation methods. The third is the management of proceeds, where the issuers should keep the funds in a sub-account or a separately managed account and keep the lenders updated on the flow of funds. Lastly, the GBP mentions methods for transparent reporting to the lenders, including the impact generated by the project.

To boost investor confidence and scale the green bonds market, the Climate Bonds Initiative has issued a voluntary standards and certification scheme to promote investments that are genuinely aligned with addressing climate change. Getting the certification can help the issuers gain traction with the investors as their bonds meet the industry standards. It helps reduce the due diligence cost as well for the lenders due to greater confidence and process transparency. Currently, the certifications can be obtained for bonds in energy, transport, water utility, and building sectors.

In India, several public organizations, banks, and private companies have issued green bonds, starting from Yes Bank in 2015. Most of the bonds have exposure to the energy sector. Indian companies have also issued Green Masala Bonds – i.e. bonds issued outside India but in Indian Rupees and not the local foreign currency. The currency exchange rate fluctuation risk is borne by the investors in this case.

Key Green Bond Issuance in India

Given below is a list of key green bond issuance in India –

| Issuer | Amount | Issued Date | Tenure | Type of Bond | Sector Exposure | Credit Rating |

| Yes Bank | INR 10bn | Feb 2015 | 10 years | NA | Energy | AA+ (CARE and ICRA) |

| EXIM Bank | USD500m | Mar 2015 | 5 years | NA | Transport, Energy | Baa3 (Moody’s) |

| CLP Wind Farms | INR6bn | Sep 2015 | 3, 4 and 5 years | Asset-backed | Energy | AA (India Rating and Research) |

| IDBI Bank | USD350m | Nov 2015 | 5 years | NA | Energy, Transport and Water Management | BBB- (Fitch) |

| Hero Future Energies | INR 3bn | Feb 2016 | 3 and 6 years | Asset-backed | Energy | NA; CBI Certified |

| PNB Housing Finance | INR 5bn | Apr 2016 | NA | NA | Buildings | NA |

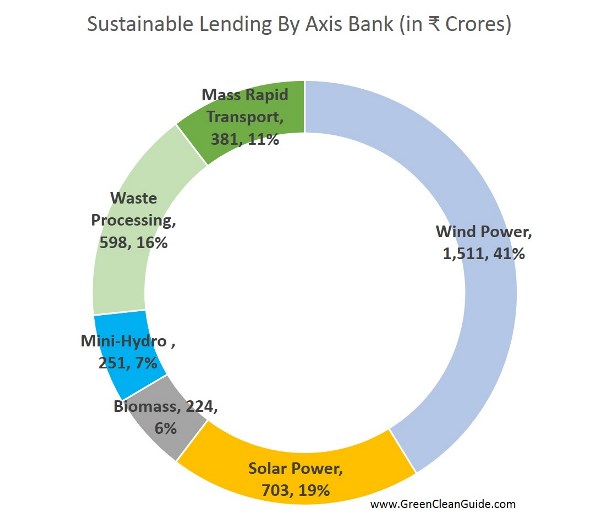

| Axis Bank | USD500m | June 2016 | 5 years | Senior, Unsecured | Energy, Buildings and Transport | GB1 – Green Bond Rating; Issuer rating Baa3 (Moody’s) |

| ReNew Power | INR 5bn | Aug 2016 | NA | Asset-backed | Energy | A+ (CARE) |

| NTPC | INR 20bn | Aug 2016 | 5 years | Unsecured | Energy | BBB (Fitch) |

| Greenko | USD500m | Aug 2016 | 7 years | Energy | ||

| ReNew Power | USD475m | Feb 2017 | 5 years | Asset-backed | Energy | Ba3 (Moody’s); B+ (Fitch) |

| IREDA | INR 7bn | Mar 2017 | 10 years | Government-guaranteed bond | Energy | AA+ (ICRA) |

| Rural Electrification Corporation | USD450m | July 2017 | 10 years | Senior Unsecured | Energy, Water and Waste Management | Baa3 (Moody’s) |

| Azure Power | USD500m | Aug 2017 | 5 years | NA | Energy | BB- (Fitch) |

| IREDA | INR19.5bn | Sept 2017 | 5 years | Government-backed | Energy | GB1 – green bond rating; Baa3 – issuer rating (Moody’s) |

| Power Finance Corporation | USD400m | Dec 2017 | 10 years | NA | Energy | Baa3 (Moody’s) |

| Indian Railway Finance Corporation | USD500m | Dec 2017 | 10 years | Senior Unsecured | Transportation | Baa2 (Moody’s) |

| ReNew Power | USD375m | Mar 2019 | 5 years | NA | Energy | BB (Fitch) |

| Adani Green Energy | USD500m | Jun 2019 | 5 years | Senior Secured | Energy | BB+ (Fitch) |

| Greenko | USD950m | July 2019 | 5 and 7 years | Organisation-backed | Energy | Ba1 (Moody’s) |

| Greenko | USD300m | Aug 2019 | 3.5 years | Organisation-backed | Energy | Ba1 (Moody’s) |

| ReNew Power | USD300m | Sept 2019 | 3 years | NA | Energy | Ba2 (Moody’s) |

| Azure Power | USD350m | Sept 2019 | 5 years | NA | Energy | NA |

| State Bank of India | USD650m | Sep 2019 | 5 years | Government-guaranteed bond | Energy | BBB- (Fitch) |

| Adani Green Energy | USD362m | Oct 2019 | 20 years | NA | Energy | BBB- (S&P) |

| ReNew Power | USD450m | Jan 2020 | Avg 5.5 years | NA | Energy | BB- (Fitch) |

| State Bank of India | USD100m | Mar 2020 | 2 years | Government-guaranteed bond | Energy | BBB- (Fitch) |

India has set itself high targets to achieve the reduction of carbon emissions, particularly by the adoption of renewable energy and increasing resource efficiency. The introduction of green bonds in India has helped organizations address the financing gap in the traditional domestic capital markets due to the inherent risks associated with the projects and the industries like renewable energy itself being at nascent stages. India is likely to become one of the largest issuers over the next few years as the green bond markets mature and standards/certifications being developed give both global and domestic investors more confidence.