Status of REC trading for the month of April, 2014

Renewable Energy Certificate (REC) trading session for the month of April 2014 has just concluded at Indian Energy Exchange (IEX) and Power Exchange India Limited (PXIL). Since this is the first trading session of financial year 2015, traded volume of RECs at both exchanges was quite low. This month has shown a 91% and 88% reduction in solar and non-solar REC traded volumes respectively as compared tothe previous month.

IEX and PXIL have 83% and 17% share in total solar REC trade volume and 21% and 79% share in total non-solar REC trade volume respectively.

Compared to April, last month, i.e. March 2014 fared much better in REC trading as it was the last month of the financial year 2014. Obligated entities (REC buyers) had targets to purchase RECs in order to fulfill their Renewable Purchase Obligations (RPO) before the end of financial year. These obligated entities are electricity distribution companies, captive consumers, and open access consumers. Obligated entities can fulfill their RPO targets either by sourcing renewable energy directly or by purchasing RECs at energy exchanges.

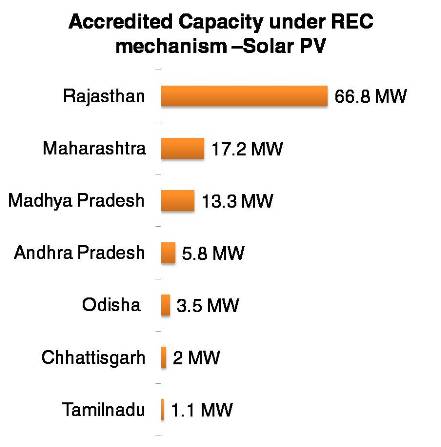

Solar REC trade

In the month of April 2014, there were total 989 Solar RECs that have been traded on both exchanges. The price was discovered at Rs. 9300 per REC (Floor price) which enabled project developers to earn Rs. 0.91 crores from their RECs sell. Unlike last month, out of total sales bid of solar RECs, only 1% RECs got traded on both exchanges (Last month trade: 5%). Following table shows details of Solar REC trading;

| Solar REC | Buy Bids | Sell Bids | VolumeTraded | PriceRs. per REC | Trade ValueRs. Crores |

| IEX | 823 | 1,47,937 | 823 | 9,300 | 0.76 |

| PXIL | 166 | 34,615 | 166 | 9,300 | 0.15 |

| Total | 989 | 1,82,552 | 989 | 0.91 |

Following graph shows the volume of solar REC traded on both exchanges and price discovered from past one year;

Non-Solar REC trade

InApril, there were a total of 79,754 non solar RECs that have been traded on both exchanges. The price discovered at both exchanges is Rs. 1500 per REC which enabled project developers to earn Rs. 11.89 crores from their RECs sale. Out of the total sales bid of non-solar RECs, only 1% RECs got traded on both exchanges.

Following table shows details of Non-solar REC trading;

| Non Solar REC | Buy Bids | Sell Bids | VolumeTraded | PriceRs. per REC | Trade ValueRs. Crores |

| IEX | 16,798 | 29,24,976 | 16,798 | 1500 | 2.51 |

| PXIL | 62,556 | 27,30,532 | 62,556 | 1500 | 9.38 |

| Total | 79,354 | 56,55,508 | 79,354 | 11.89 |

Following graph shows the volume of non solar REC traded on both exchanges and price discovered from past one year;

Reference: Indian Energy Exchange (IEX) and Power Exchange India Limited (PXIL), REC registry of India