Solar REC market in India – History, Take off and Current Scenario

For around two and a half years, we have seen how Renewable Energy Certificate (REC) Mechanism has grown in India and how the trade of REC has increased. The REC mechanism was introduced in India in 2010 to promote Renewable Energy Sources and to support Renewable Purchase Obligation (RPO) mechanism. Since the trading of REC began in March 2011, the market has taken off well and has matured over the period. Globally, Europe and United States are the biggest markets of Renewable Energy. However, the REC market is still considered new in India.

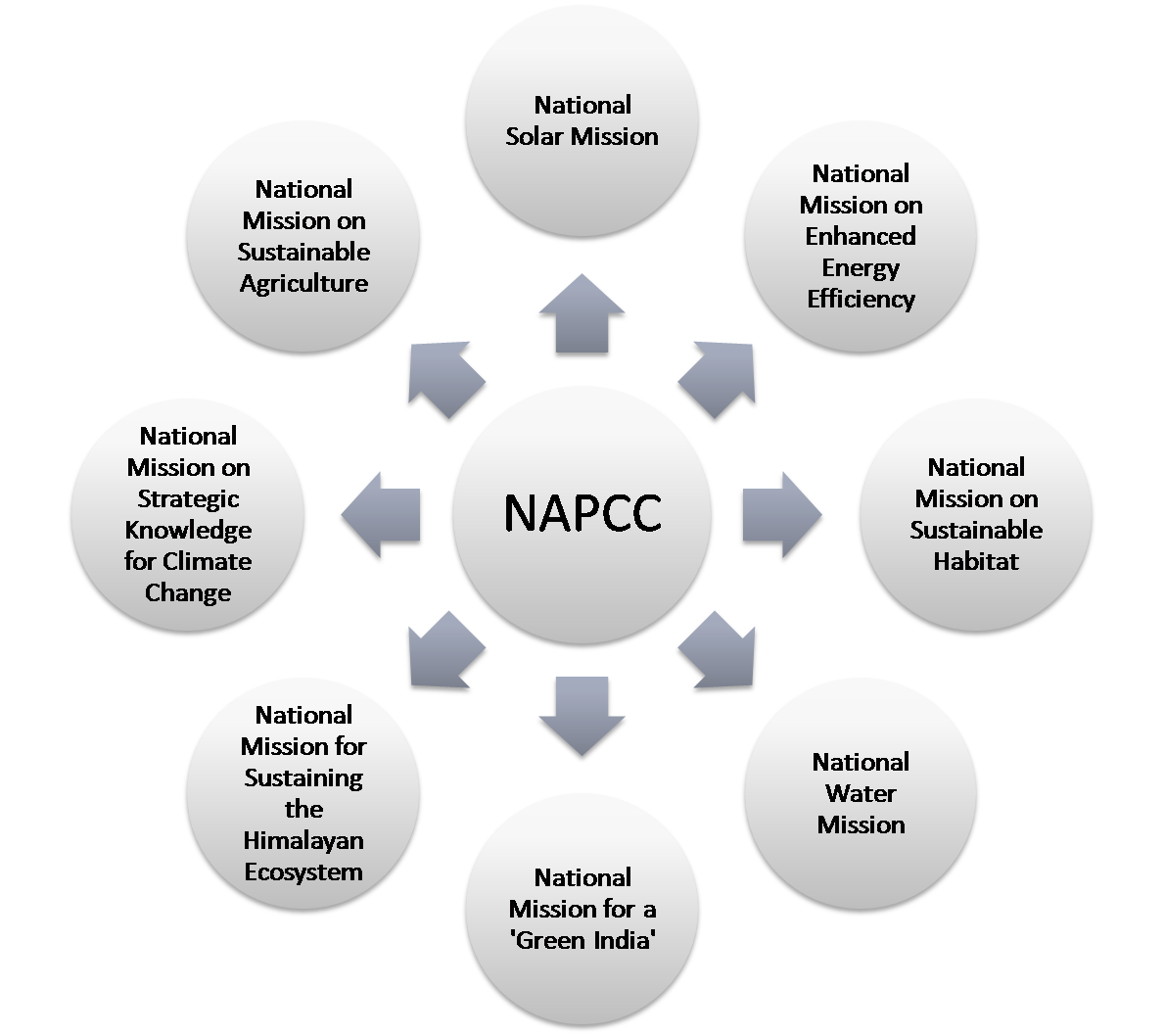

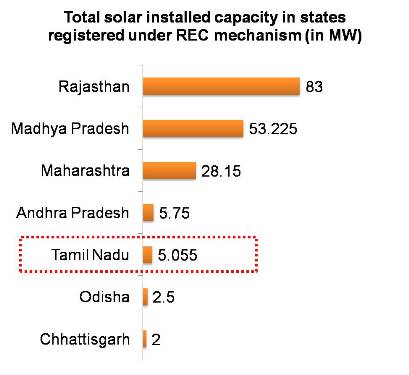

India has a vast solar energy potential. About 5,000 trillion kWh/year of energy is incident over India’s land area with most parts receiving 4-7 kWh per sq. m per day (JNNSM document). Grid connected solar energy projects are eligible to earn RECs (Please click here to know more about REC mechanism, relevant regulations and cost involved). Since the REC mechanism was introduced in India, a total of 157 MW of installed capacity for solar has been installed. A critical factor for continuous growth of solar energy is continued government support in India through policy interventions. Sudden changes in the policy discourage investors hence it is essential that the government maintain its support and ensures clarity to prospective investors.

The REC market is dominated traditionally by wind energy. Solar REC projects started with a total registered capacity of 8 MW in April 2012. The REC market witnessed its first solar REC trade in May 2012 trading session. There was a total of 1,642 buy bids at both the exchanges (Indian Energy Exchange and Power Exchange India Limited) and a total of 249 sell bids. However, only ten RECs were traded finally at Rs. 13,000 per REC. This can be attributed to unwillingness of buyers to pay high prices for solar RECs so early in the year 2012. This however has changed as the market matures.

Between May 2012 to June 2013, there were total 19,412 RECs have been traded on energy exchanges. In June 2013, 1479 RECs were traded at price of Rs. 9,300 per REC. The total trade value for the month of June 13 was Rs. 1.37 crores.

Possible revenue from solar project

Following table shows the possible revenue that can be earned from a solar energy project if registered under REC mechanism. The calculations have been done for grid connected solar PV project of capacity 1 MW. Solar project of this capacity can generate around 1577 RECs annually. To arrive at this number, 18% of plant load factor has been considered. As per the REC regulations, the price of solar RECs has been fixed by the government. Floor price of solar REC is Rs. 9,300 and Forbearance price is Rs. 13,400 for per REC. In following table, calculations using the price of REC have been segregated under three different columns. These columns are entitled with best case scenario, most probable scenario and worst case scenario. The most probable scenario is the average of floor and forbearance price. Please click here to know more about various fees under REC accreditation, registration, issuance and trading.

|

Possible revenue from 1 MW solar project under REC mechanism |

||||

|

Best case scenario |

Most probable scenario |

Worst case scenario |

||

| Revenue | Total Revenue from REC |

2,11,29,120 |

1,78,96,680 |

1,46,64,240 |

| Expenses for one year | Accreditation fees (One time) |

50,562 |

50,562 |

50,562 |

| Registration fees (One time) |

7,865 |

7,865 |

7,865 |

|

| Issuance fees to NLDC |

17,717 |

17,717 |

17,717 |

|

| One time Portfolio Opening Charges at IEX |

40,000 |

40,000 |

40,000 |

|

| Trading fees by IEX |

31,536 |

31,536 |

31,536 |

|

| Total expenses for one year |

1,47,680 |

1,47,680 |

1,47,680 |

|

| Net profit for one year |

2,09,81,440 |

1,71,97,120 |

1,45,16,560 |

|

Note: Rs. 10/REC is considered for the REC issuance fees by NLDC. Service tax is added in the issuance fees. Values are for reference only.

As the compliance of RPO can be fulfilled by buying RECs on energy exchange, there are assured buyers for the RECs. However, obligated entities are not displaying enough response and enthusiasm in purchasing RECs. REC markets are still in the process of stabilizing and this will take time. State Electricity Regulatory Commissions of various states are working towards improvement RPO compliance across obligated entities. We can experience better market for RECs in near future.

Still have questions whether to opt for REC mechanism or not; please click here to know more on key important question to be asked before choosing REC mechanism for renewable energy projects.

Today on Google along with test a number of your first posts. Your blog post is just wonderful.

-William