Status of REC trading in the month of November 2013

November 2013 was a good month for Renewable Energy Certificates (REC) trading. Non-solar REC experienced an increasing trend in the total traded volume. This month, there were a total of 0.3 million RECs traded on both exchanges. Solar RECs trading shows a declining trend. There were a total of 7,354 RECs traded in this month as compared to 9,257 of last month. However, this is far better than the average of solar RECs traded over last 12 months.

November 2013 was a good month for Renewable Energy Certificates (REC) trading. Non-solar REC experienced an increasing trend in the total traded volume. This month, there were a total of 0.3 million RECs traded on both exchanges. Solar RECs trading shows a declining trend. There were a total of 7,354 RECs traded in this month as compared to 9,257 of last month. However, this is far better than the average of solar RECs traded over last 12 months.

The increased momentum of REC trading can be because of compliance of Renewable Purchase Obligation (RPO) on state utility companies and other obligatory entities. These entities have to comply with their RPO targets by 31st March 2014. Therefore REC trading is expected to go up in the coming trading sessions.

Solar REC trade

In the month of November 2013, there were total 7,354 Solar RECs that have been traded on both exchanges. The price was discovered at Rs. 9300 per REC (Floor price). It means that solar energy project developers earned a total of Rs. 6.83 crores through their RECs selling.

In November 2013, the opening balance of Solar RECs was 58,954. There were a total of 2,936 RECs that have been issued in the same month. As mentioned in the table below, total 7,354 RECs were traded on the exchanges and hence remaining balance is 54,506 carried forward for the next month. Therefore, there is still an inventory of 54,506 RECs exists and remain untraded.

| Solar REC | Buy Bids | Sell Bids | VolumeTraded | PriceRs. per REC | Trade ValueRs. Crores |

| IEX | 6,983 | 45,819 | 6,983 | 9,300 | 6.49 |

| PXIL | 361 | 15,538 | 371 | 9,300 | 0.34 |

| Total | 7,354 | 61,357 | 7,354 | 6.83 |

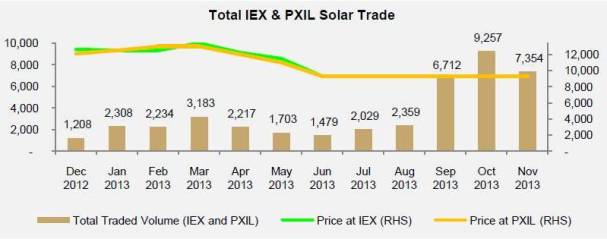

Following graph shows the volume of REC traded on both exchanges and price discovered from past one year;

October 2013 experienced highest volume of REC traded i.e. 9,257 (highest volume since the beginning of solar REC trading).

Non-Solar REC trade

Wind projects are still dominating non solar REC inventory. In this month, there were a total of 3,08,928 non solar RECs that have been traded on both exchanges. The price discovered at both exchanges is Rs. 1500 per REC which enabled project developers to earn Rs. 46.33 crores from their RECs sell.

This month the opening balance of non solar RECs was 4.05 million. 0.4 Million RECs have been issued in the same month. However, only 0.3 million RECs were traded on the exchanges and hence remaining balance is 4.15 million RECs carried forward for the next month and remains untraded.

| Non Solar REC | Buy Bids | Sell Bids | VolumeTraded | PriceRs. per REC | Trade ValueRs. Crores |

| IEX | 97,743 | 27,60,452 | 97,743 | 1,500 | 14.66 |

| PXIL | 2,11,185 | 13,79,113 | 2,11,185 | 1,500 | 31.67 |

| Total | 3,08,928 | 41,39,565 | 3,08,928 | 46.33 |

Reference: Indian Energy Exchange (IEX) and Power Exchange India Limited (PXIL), REC registry of India, Agneya Carbon Ventures –monthly newsletter.